Mortgage Market Trends, Rates, and Updates Delivered to Your Inbox Weekly. The Easiest Way to Stay Informed.

CLICK HERE TO SIGN UP

Rates edge down with speculation about Fed policy reversal;

Will Lyft IPO boost our market?

Market Update

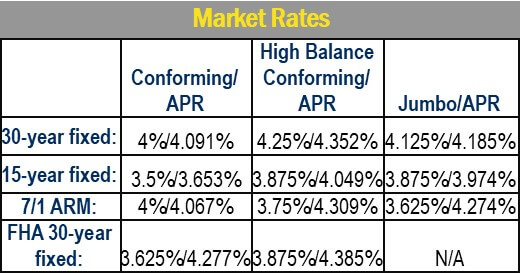

Last week we had data that was very supportive of lower rates, especially release of the Core PCE inflation index that showed year over year inflation diminishing from 2% to 1.8%. The 10 year Treasury bond traded at a yield as low as 2.34% this week but ended at 2.41%, a slight improvement for the week. Rates overall declined by about .125% in response to these statistics.

Some analysts are speculating that the Fed may actually drop rates later this year, especially if the economy appears to falter. The Fed is now concerned about the effect of the China trade war on the US economy. Late this week there was some evidence that the two sides are making more progress on making real progress on key issues, especially intellectual property theft.

Mortgage Market

With rates now drifting near/below 4% the market may have all the incentive it needs to be stable or stronger this year. However an added factor happened this week with the Lyft IPO. This will not have an immediate effect on home buying activity from Lyft employees because they need to get past their lockout/vesting period, it represents capital that is waiting in the wings to be put into our real estate market and that we should see surfacing in the Fall.

©2019 Finance of America Mortgage LLC | Equal Housing Lender | NMLS 1071 | Mortgage Banker License #0910184 | Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act. All information contained herein is for informational purposes only and, while every effort has been made to ensure accuracy, no guarantee is expressed or implied. Any programs shown do not demonstrate all options or pricing structures. Rates are subject to change without notice and are subject to underwriting approval. Some products may not be available in all states and restrictions apply. Check with your Mortgage Advisor for specific down-payment requirements. Rates effective as of 4/1/2019